The appearance in recent years, of two events of great importance such as the crisis and digital transformation has meant a break with previous decades. In a very short and abrupt time the barriers to entry to all markets that protected the incumbent companies have burst; jobs are reinventing, not without painful consequences, with the fourth industrial revolution and a new profile of citizens is emerging demanding exemplaryness and transparency.

We live in VUCA times, as I had explained in another previous article in this Blog, and for that reason we must understand the change we are living. Changes in the labor market with the emergence of entrepreneurship. Changes in generations with the arrival of Millennials and the Z generation. Changes in companies with the advent of open innovation and corporate entrepreneurship. Changes in public policies with the emergence of the circular economy, public-private collaboration and intrapreneurship. Changes that affect us all and that go from cybercrime through the new cryptocurrencies.

According to the study by the creative agency Scratch earlier this year 2019, called the Millennial Disruption Index (MDI), more than 10,000 Millennials were interviewed in the United States and solicited their opinions on 73 companies in 15 industries. The Millennial Disruption Index represents the results of three years on the disruption of the industry at the hands of those born between 1981 and 2000.

The results were amazing given that the survey came to determine that at least "71% of Millennials would prefer to go to the dentist than enter a Bank and 1 in 3 of them is open to change banks in the next 90 days" If we observe in the world what the trend is, we can observe cases such as Australia that have one of the populations with the highest digital participation in the world, with 73% of people using digital banking at least once a week. ; providing a better digital experience is probably key to retaining and acquiring new customers, especially younger generations.

The time has come for financial disruption in the world

If we look closely at the result of the study, we can determine that:

- The four largest banks in the United States are among the top ten brands least loved by Millennials.

- 71% of Millennials would rather go to the dentist than listen to what a Bank has to say;

- 73% of 10,000 Millennials would be more excited about a new financial offer from a technology company than from their own Bank;

- Half of all Millennials expect Google, Amazon and Square to enter with business in finance; and

- 33% think they won't need a bank at all.

Does this surprise you? This segment of the population has grown in a digital technological era in which trust in the Bank was eroded due to the financial crisis and an almost stagnant economy. This is also a period in which new emerging technologies have allowed companies such as Simple, Moven, Square and PayPal among others, to be more relevant with a generation that prefers to manage finances on their phone than in a branch.

The response of the Banks, to a greater extent, has been to provide mobile access to online banking platforms. Only banks created for mobile devices such as Simple, Moven, GoBank, Fidor, mBank, Soon and Hello seem to see the future. Nevertheless; That is not the solution to this trend.

How should banks respond?

The approach that has been growing as a trend in recent years is the Digital Transformation assuming emerging technologies such as: Artificial Intelligence (AI), Internet of Things (IoT), Blockchain, Cybersecurity among others. An entire industry needs to reinvent what Banking means to consumers and determine the best way to take advantage of new technology in the daily activities of consumers. Downloadable bank accounts need to replace the plastic in short.

The banking sector is reaching a tipping point. Millennials (as well as previous generations) are using other industries as a benchmark for what they expect from their financial services partner. If they do not receive the experience they want, the results of this survey make it clear that they will look elsewhere (outside of traditional providers) to meet their needs.

What is the future of banks?

Millennials are ready for disruption: they hate the traditional way banks operate and expect them to disappear completely. Nevertheless; Millennials dislike of banks provides a great opportunity for those who work inside and outside the financial industry.

In these times, one of the main factors for banks to differentiate themselves from the competition for this demographic group is to provide significant customer service and a sense of trust, since the Millennial Disruption Index (MDI) shows that more than half of the respondents (53%) do not believe that their Bank offers them something unique.

Millennials have proven faster to change banking relationships than their predecessors. A recent study by Accenture showed that 18 percent of Millennials changed their main banking provider in the last 12 months, compared with 10 percent of those between 35 and 54 years old and only 3 percent of those older of 55

Banks that do not provide an omnichannel experience will be left behind by the most expert competitors in technology.

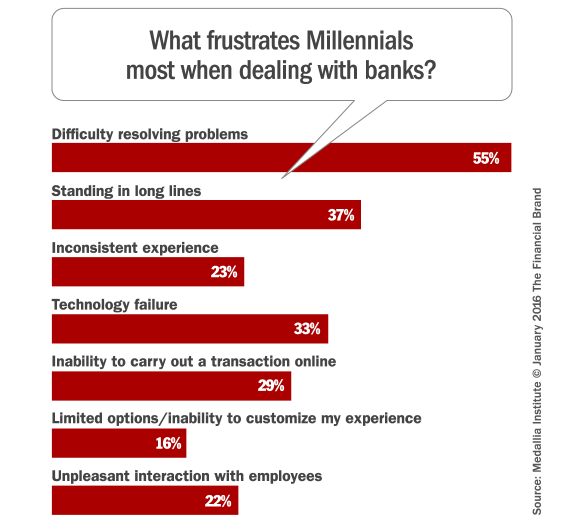

An investigation conducted by the Medallia Institute of “The Banking of the Millennium” in 2016, indicates that 12% of Millennials say they have used Apple Pay, and 16% have used Google Wallet. In addition, Millennials seem to be increasingly active in the mobile payment space. Seven out of ten (68%) would consider paying someone using person-to-person payments through the mobile banking application, and more than two out of five (41%) would consider or have already used their smartphone to make a purchase When paying.

An advanced digital user experience is important. Generation Y has been at the center of digital disruption for the past 20 years, so Banking is waiting at any time and anywhere across multiple devices. Banks that do not provide a perfect omnichannel experience will quickly be left behind by more tech-savvy competitors such as: StashInvest, Simple, Chime or Varo. Nearly two-thirds of Millennials surveyed by the Medallia Institute said innovation is important to win them as customers. Young people want new and convenient ways to interact with banks, as well as the ability to complete transactions without much effort.

DO YOU WANT TO SHARE YOUR ARTICLE COMMENT HERE?